![]()

Focused Business Segments Achieved Sustained Growth; Net Profit Rose Steadily

HONG KONG, Aug 29, 2017 - (ACN Newswire) - Legend Holdings Corporation ("Legend Holdings" or the "Company"; stock code: 3396.HK) today announce the unaudited interim results of the Company and its subsidiaries for the period ended 30 June 2017 (the "Reporting Period").

Financial Highlights

Six months ended 30 June 2017:

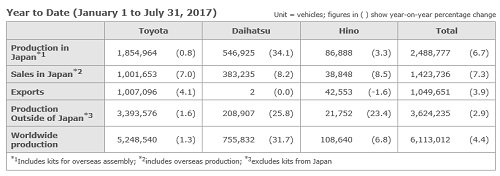

- Revenue (including continuing operations and discontinued operations) was RMB142.482 billion, representing an increase of 6% year on year; in which the revenue of continuing operations increased by 9% year on year

- Net profit attributable to equity holders of the Company was RMB2,687 million, representing an increase of 4% year on year; in which net profit from continuing operations attributable to equity holders of the Company increased by 9% year on year

- Basic earnings per share were RMB1.15, representing an increase of 5% year on year, in which basic earnings per share of continuing operations increased by 10% year on year

During the Reporting Period, Legend Holdings realized revenue (including continuing operations and discontinued operations) of RMB142.482 billion, representing an increase of 6% year on year, in which the continuing operations revenue increased by 9% year on year; net profit attributable to equity holders of the Company amounting to RMB2,687 million, representing an increase of 4% year on year, in which net profit from continuing operations attributable to equity holders of the Company increased by 9% year on year; basic earnings per share were RMB1.15, representing an increase of 5% year on year, in which basic earnings per share of continuing operations increased by 10% year on year.

The strategic investments of the Company fully focused on consumption and services. Revenues of five segments have been further increased. Three major segments, namely financial services, innovative consumption and services as well as agriculture and food, all recorded substantial growth of revenue, the portfolio companies sustained its sound development. Meanwhile, financial investments of the Company recorded encouraging returns, both management scale and profit contribution increased to bring continuous and steady cash flow to the Company. Also, new funds were raised successfully, thereby laying a solid foundation for future development. In addition, the Company continued to help the portfolio companies in obtaining resources for development through various means of capital operations.

Mr. ZHU Linan, President of Legend Holdings, stated that, "In the first half of 2017, global economy generally had a sign of recovery, China's economy was steadily improving. Rooted in our established strategies, Legend Holdings insisted on the unique 'two-wheel-drive' business model 'strategic investments + financial investments', to optimize property development business and accelerate the launch of capital operations. Meanwhile, by taking the advantage of China's economic growth momentum, the Company actively pay attention to and participate in the issues of consumption upgrading, supply-side structural reform, SOE reform and 'the Belt and Road'. Legend Holdings continued to layout the strategic convergence to enhance and create the value of investment portfolio. In the future, building on the economic trend, the Company will implement its development strategies unswervingly and achieve synergy of strategic and financial investments, so as to push forward the accomplishment of 'two-wheel-drive', as well as to engage in building new pillar businesses to create better long-term returns for investors."

Strategic Amplify on Focused Segments and Dynamic Optimize Portfolio Investments

During the Reporting Period, five segments of strategic investments increased in revenues, in which the focused segments such as financial services, innovative consumption and services as well as agriculture and food recorded robust growth, each business segment was entering into the rapid growth track.

Each business of financial services segments achieved sound growth, revenue increased by approximately 204% year on year to RMB1,688 million. The business development of JC Finance & Leasing and Kaola Technology remained strong. During the Reporting Period, revenue and net profit of JC Finance & Leasing amounted to RMB302 million and RMB85 million, representing a growth of 193% and 183% respectively year on year. The outstanding balance of loans of Kaola Technology amounted to approximately RMB6.7 billion and the maximum single-day credit loan amount of individual loan business exceeded RMB100 million. By developing the Company's features and advantages, and increasing the impetus of capital to the development of real economy, financial segment is expected to be main pillar of the Company.

The Company continued to amplify in innovative consumption and services segment, revenue increased by approximately 30% year on year to RMB1,222 million. To grasp with the market opportunity in upgrading consumption and national economic development, the Company has been actively seizing new opportunities and optimizing stock assets. During the Reporting Period, Bybo Dental has substantially met our goal in its presence in China and established 207 clinics and hospitals. Bybo Dental paid attention to the development of business scale and medical technology. Shanghai Neuromedical Center, as a neurology specialist comprehensive hospital, recorded a year on year revenue growth of over 70% in the first half of the year. CAR has consolidated its leading position in China's car rental market. During the Reporting Period, Legend Holdings invested in Eastern Air Logistics Co., Ltd. ("EAL") and strategically participated in the SOE reform. The Company will help EAL in develop its value by utilizing extensive experience in business operations, experience of SOE reform and commercial resources. It is expected to create more opportunities to expand cooperation in the relative fields. In addition, the Company also monitored the investment opportunities in niche segments of the education industry.

Accelerating supply chains portfolio in agriculture and food segment, revenue increased by approximately 64% year on year to RMB2,008 million. With the aim of improving food qualities for consumers, the Company has developed two supply chains of fresh fruits and fresh seafood and link to overseas resources which has the potential synergy with the consumption market of China intrinsically. The Company looked forward to enhance investment and operation efficiency through the industrial integration and a global presence in the future. In 2017, in view of the supply chain of fresh fruits, through the merger and acquisition of the Asian business of Capespan, the Company has achieved to cover Hong Kong, Southeast Asia, Japan and Korea markets, marking the commencement of the global presence of our fruit business channel. As for the seafood supply chain, we own KB Seafoods, a leading Australian seafood supplier, based on which the expansion and integration of global seafood supply chain system will be launched.

In view of the IT segment, Lenovo continued its focus on striking a balance between growth and profitability in its PC and smart device business while executing its transformation strategy in its Mobile and Data Center businesses in the first half of 2017. For the new materials segment, Levima New Materials Company, subsidiary of Levima Group, successfully introduced RMB850 million strategic investment from CAS Holdings. The investment enhanced its capital structure and at the same time, strengthened the accumulated technology in innovative research and development in the new materials and fine chemical sector and development potential of the Company. Moreover, the Company disposed the entire equity interest of Phylion Battery, the overall valuation was RMB2.8 billion. The Company not only received a satisfactory financial return, but also optimized allocation of resources and pushed forward the launch of the strategic convergence through the disposal.

Substantial Growth of Net Profit in Financial Investments and Continuous Expansion of the Scale of New Funds

Financial investments segment recorded encouraging returns during the reporting period. Profit increased 127% year on year to RMB2,133 million, cash flow remained stable of approximately RMB1,450 million. Numerous new project investments were completed and launched by three funds management companies.

During the reporting period, Legend Star had over 30 onshore or offshore investment projects covering frontier fields such as aerospace technology, intelligent vehicle, big data, artificial intelligence and quantum technology. Among the projects under management, 29 projects have finished another round of financing; one project that Unison has successfully listed on the NEEQS while the exit of three projects has been carried out. It promoted the establishment of Comet Labs at the end of 2015, the artificial intelligent accelerator, with the global presence in the artificial intelligent industry. There were 11 invested projects during the reporting period.

Legend Capital accumulatively completed 25 new project investments during the reporting period, covering startup stage and growing stage enterprises in TMT and innovative consumption, modern services and intelligent manufacturing, healthcare, and culture and sports sectors. 10 projects were fully or partially exited, contributing cash inflow of RMB310 million for Legend Holdings. Among its portfolio companies, three enterprises were listed on the domestic and overseas capital market through IPO, namely Fullhan Microelectronics, Tanyuan Technology and WuXi Biologics. As of 30 June 2017, a total of 42 portfolio companies have been successfully listed and 13 were listed on the NEEQS.

Hony PE funds fully or partially exited eight projects during the reporting period, while mezzanine funds fully or partially exited five projects, contributing cash inflow over RMB860 million for Legend Holdings in total. Meanwhile, one of its portfolio companies was listed in Hong Kong's capital market, namely Hospital Corporation of China Limited. As of 30 June 2017, 40 portfolio companies have been successfully listed onshore or offshore (including PIPE investment) and another three were listed on NEEQS. Hony Capital has fully exited its investments in 36 companies.

In addition, new funds were raised successfully during the reporting period, leading to continuous expansion of financial investments segment. Legend Capital completed the final closing of the seventh USD fund and raised the second culture and sports fund, the total raised fund amounted to approximately RMB2,940 million. Hony Capital raised the second property value-added strategic fund with RMB2,560 million, and raised the Haidian technology industry space optimization fund with RMB1,075 million. Legend Star newly launched third RMB fund and third USD fund, the newly raised fund amounted to RMB357 million.

As a pioneer in China's alternative investment sector, Legend Holdings seek to capture investment opportunities at various stages of a company's development through angel investment, venture capital and private equity investment and other investments to expand its financial investment business. Each of our investment arms has a different specialization and focus, which allows us to target a broad range of investments, as well as to build a wide network in the investment community, expand information sources and diversify our investment risks.

Looking forward, Mr. LIU Chuanzhi, Chairman of Legend Holdings, states that, "Since the establishment of Legend Holdings, we keep promoting timely strategies in the basis of achieving higher goal and determining the trend of China's economic development. While the capital market in China is still in the embryonic stage, the Company enters the investment sector, eventually created today's strategic pattern of "capital + industry". Financial capital is an essential driving force for the development of the real economy, Legend Holdings has been committed to making direct investments in order to build up a leading enterprise in various segments and an outstanding investment portfolio. At present, China's economic development is entering into a new stage of "norm" while the Government vigorously promotes different themes of economic development. This is consistent with Legend Holdings' own practice, hence, creating a broad platform for us to excel. Going forward, we will base on our strategy to fully capture any opportunities through our capability of creating value in regard to mechanism reform, strategic development, supply chain synergy and management, to assist in the continuous development of our invested enterprises and create values for investors and society."

Appendix: Business Review

Strategic Investments

IT: During the reporting period, the revenue was RMB134,672 million. In the first half of 2017, despite challenges in the slower PC market growth and currency volatility, Lenovo remained a leading player in the PC plus Tablet market and continued to strike a balance between growth and profitability. Mobile business started to show signs of flourishing, Lenovo continued to have an extensive global operation and recorded strong shipments growth in Latin America and Western Europe. Lenovo continued to execute the transformation plan of its data center business with investments in building direct sales capability, strengthening the channel and product solution capabilities to drive future sustainable profitable growth. Lenovo's Capital will continue to invest in AI (artificial intelligence), IoT (internet of things), Big Data and VR/AR (virtual reality/augmented reality) to illustrate its implementation of "Device + cloud" in order to develop new business and consolidate existing business. Lenovo also made progress in expanding its ecosystem with Lenovo ID users reaching 225 million cumulative users.

Financial Services: During the reporting period, the revenue was RMB1, 688 million. Legend Holdings has established a broad presence in the financial services business and obtained various financial licenses and permits. Based on a large pool of our portfolio companies and customer resources, we promoted synergic development of our financial businesses. The net profit of financial services was RMB694 million. Our subsidiary Kaola Technology mainly provided innovative financial services to small and micro enterprises through internet. In the first half of 2017, Kaola Technology had robust business growth and recorded revenue of RMB796 million and net profit of RMB142 million. Zhengqi Financial continued to enhance business structure, micro loans, credit guarantee and financial leasing sustained their steady growth, while commercial factoring business grew rapidly. Revenue grew by approximately 31% to RMB590 million. JC Finance & Leasing realized a sound and rapid development since its incorporation in November 2015. During the reporting period, its revenue and net profit amounted to RMB302 million and RMB85 million, representing a growth of 193% and 183% respectively as compared with the corresponding period of 2016. Lakala Payment submitted to the China Securities Regulatory Commission the application for the initial public offering and listing its shares on the ChiNext board of the Shenzhen Stock Exchange on 3 March 2017.

Innovative Consumption and Services: During the reporting report, the revenue was RMB1,222 million. Legend Holdings established our presence in air logistics sector by strategic investment in EAL. At the same time, we monitored the investment opportunities in niche segments of the education industry. In July, we made investment in Better Sun Educational Group and became its controlling shareholder. We will further participate in educational consumption upgrade by means of investment and expects to make contribution to the society with its enhanced value. Bybo Dental has substantially met our goal in its presence in China and paid attention to the development of business scale and medical technology. As of 30 June 2017, Bybo Dental had 207 outlets, comprising 55 hospitals and 152 clinics, representing a growth of 15% from the 180 as at the end of June 2016, covering 25 direct-controlled municipalities or provinces. The number of Bybo Dental's dental chairs rose from 2,290 as of 30 June 2016 to 2,742 as of 30 June 2017. Shanghai Neuromedical Center mainly provides clinical neurology specialist medical service. The number of outpatient visits and discharged patients increased significantly, its revenue substantially increased to RMB105 million, representing a growth of 70% as compared to the corresponding period of last year. Zeny Supply Chain continued to explore the business model of light asset operation and gradually developed innovative businesses such as financial businesses of supply chain. Return levels of the projects increased continuously through fine-tuned operation and loss continuously decreased. CAR continued to implement the strategy of enhancing customer experience and optimizing cost structure. As of 30 June 2017, the total size of operating fleet of CAR reached 88,301 cars, increasing by 0.8% as compared with the corresponding period of last year; the total size of fleet reached 100,029 cars, increasing by 0.3% as compared with the corresponding period of last year. CAR had 823 directly operating service spots in 104 cities of China, covering all first-tier and second-tier cities and main tourist spots in the country.

Agriculture and Food Segment: During the reporting period, the revenue was RMB2,008 million. With the aim of improving food qualities for Chinese consumers, the agriculture and food segment has developed two supply chains of fresh fruits and fresh seafood. Its income increased significantly, net profit increased from RMB25 million in the corresponding period of last year to RMB141 million. In view of the supply chain of fresh fruits, through the merger and acquisition of the Asian business of Capespan, we have achieved to cover Hong Kong, Southeast Asia, Japan and Korea markets, marking the commencement of the global presence of our fruit business channel. Golden Wing Mau continued its overseas presence and carried out in-depth integration of the upstream and downstream of fruit business at the same time. During the reporting period, the revenue and net profit increased by 43% and 52% year-on-year respectively. As for the seafood supply chain, we own KB Seafoods, a leading Australian seafood supplier, based on which the expansion and integration of global seafood supply chain system will be launched. The overall business growth of KBI was in line with expectations. The significant effect of capital expenditures in 2016 resulting in great improvement in the operating efficiency of fresh food processing business in Western Australia; and KBI becoming the best supplier of seafood of the year of Woolworths, the largest operator of chain supermarkets in Australia. In May 2017, KBI completed the acquisition of 100% and 40% interests in Carnavan No.1 Fishing Trust (CNFT) and Darwin Fishing Trust (DFT), respectively. KBI will own two large purse seine fishing vessels in Shark Bay, Western Australia, which are mainly for fishing prawns, tiger prawns, scallops and other wild seafood. Such merger and acquisition will enable KBI to further consolidating the control over upstream resources and act as a platform for more merger, acquisition and integration of upstream resources in Australia, with a view to enhancing integration of the company's industrial chain, thereby strengthening the comprehensive competitiveness in the market. The transaction was approved by Foreign Investment Review Board of Australia. As its products portfolio continuously optimized and the differentiated competitive model became more developed, Funglian Group's operating profit increased by 299% year-on-year. At the same time, Legend Holdings completed the acquisition of Wanfu Biotechnology (300268.SZ) (now renamed as "Joyvio Agriculture"), a ChiNext listed company of China. As a platform for strategic industry development under Joyvio, the company will facilitate a more efficient launch of our business layout and industrial integration with the advantage of China capital market in future.

New Materials: During the reporting period, the revenue was RMB2,588 million. Based on our core strategy: strategic investments fully focused on three major sectors segments, namely financial services, innovative consumption and services as well as agriculture and food. We disposed the entire equity interest of Phylion Battery during the reporting period. The overall valuation was RMB2.8 billion. Through the disposal, we enhanced investment portfolio and pushed forward the launch of the strategic convergence and received a satisfactory financial return. CAS Holdings strategically invested RMB850 million in Levima New Materials, the investment realized the access of intensive base of accumulated technology and innovative resources of Chinese Academy of Sciences by Levima New Materials. The investment enhanced its capital structure and at the same time, strengthened the accumulated technology in innovative research and development in the new materials and fine chemical sector and development potential of the company. Since 2016, by means such as capital injection, the shareholding of the management and introducing strategic investment from CAS holdings, we laid a solid foundation for Levima New Materials to develop independently into an outstanding enterprise in the new materials sector and have the capital market access.

Financial Investments

Legend Capital (Venture Capital)

As of 30 June 2017, totally managed seven USD funds, four RMB funds, two early-staged RMB funds, one USD fund specialized in healthcare sector, one RMB fund specialized in healthcare sector, two RMB funds specialized in culture and sports sector and one fund in red-chip return concept. In the first half year, one new RMB fund was launched and the final closing of one USD fund was completed, further expanded the asset under management. The raised fund amounted to RMB2.94 billion during the reporting period. In the second half of 2017, the newly raised funds will still focus on Chinese enterprises and cross-border opportunities at the start-up stage and growing stage in TMT, innovative consumption, modern services and intelligent manufacturing, healthcare, and culture and sports sectors.

During the reporting period, Legend Capital accumulatively completed 25 new project investments, covering the above investments focus. 10 projects were fully or partially exited, contributing cash inflow of RMB310 million for Legend Holdings. Among its portfolio companies, three enterprises were listed on the domestic and overseas capital market through IPO, namely Fullhan Microelectronics, Tanyuan Technology and WuXi Biologics.

As of 30 June 2017, a total of 42 portfolio companies have been successfully listed and 13 were listed on the NEEQS, while the average internal rate of return for exit projects ranging between 35% and 40%.

Hony Capital (Private Equity Investment)

As of the first half of 2017, Hony Capital totally managed eight equity investment funds, two mezzanine funds and two property funds. During the reporting period, raised the second property value-added strategic fund with a size of RMB2.56 billion; meanwhile, the raising of the Haidian technology industry space optimization fund under the strategic cooperation between Hony property fund and a SOE of Beijing Haidian region commenced. RMB1.075 billion were raised during the reporting period. Currently the fund raising is still underway and the size is expected to be further expanded.

PE funds focus on SOE reforms, development of private enterprises and cross-border mergers and acquisitions. It persistently carries out investment practice with specific industry concentration in consumption, services, general healthcare, advanced manufacturing and mobile internet. Six new projects or additional investment on existing projects were completed during the reporting period.

The investment strategies of mezzanine funds mainly focus on mergers and acquisitions financing, asset securitization financing and special opportunity financing (e.g. corporate bridge facility, secured-asset financing and asset restructuring opportunities, etc.) etc. Four new investments or additional investments were completed during the reporting period.

Property fund focuses strategically on the domain of office buildings in first-tier cities to create excess return over the market average by applying various value-added means. More than three new investment projects were in progress and currently up to the delivery stage.

PE funds fully or partially exited eight projects, while mezzanine funds fully or partially exited five projects during the reporting period, contributing cash inflow over RMB860 million for Legend Holdings in total. Meanwhile, one of its portfolio companies were listed in Hong Kong's capital market, namely Hospital Corporation of China Limited.

As of 30 June 2017, 40 portfolio companies have been successfully listed onshore or offshore (including PIPE investment) and another three were listed on NEEQS while 36 companies had been fully exited. The median of the internal rate of return on these investments was above 17%.

Legend Star (Angel investment)

As of 30 June 2017, totally managed four funds, of which the size amounted to approximately RMB1.5 billion with an aggregate of over 190 onshore or offshore investment projects, focusing on the early investment of TMT, healthcare and intelligent technologies. Third RMB fund and third USD fund were newly launched during the reporting period. As of 30 June 2017, the newly raised fund amounted to RMB357 million.

During the reporting period, Legend Star had over 30 onshore or offshore investment projects covering frontier fields such as aerospace technology, intelligent vehicle, big data, artificial intelligence and quantum technology. Among the projects under management, 29 projects have finished another round of financing, one project of Unison have successfully listed on the NEEQS while the exit of three projects have been carried out.

It promoted the establishment of Comet Labs at the end of 2015, the artificial intelligent accelerator, with the global presence in the artificial intelligent industry. There were 11 invested projects during the reporting period.

About Legend Holdings Corporation

Legend Holdings is a leading large investment group in China. The Company has built an innovative business model of "strategic investments + financial investments" with synergy between these "two-wheel-drive" businesses. Through strategic investments, the Company invests in five segments: IT, financial services, innovative consumption & services, modern food & agribusiness and new materials. The Company's financial investments business primarily consists of angel investments, venture capital and private equity across all stages of a company's life cycle. Over the past 32 years, under the leadership of the Company's Founder and Chairman, Mr. Liu Chuanzhi, and President, Mr. Zhu Linan, the Company has capitalized on its understanding of China's key development themes, complementary investment businesses and extensive management expertise to cultivate a number of outstanding and influential enterprises. By promoting business alignment and consolidation, and continuously optimizing its investment portfolio, the Company realizes sustainable growth in its corporate value. The Company's strategic investments business focuses on three major fields: financial services, innovative consumption & services and modern food & agribusiness, and continuously pays attention to overseas assets investment.

Copyright 2017 ACN Newswire. All rights reserved. www.acnnewswire.com