![]()

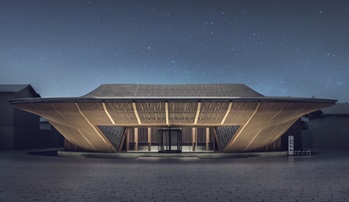

BANGKOK, Aug 15, 2018 - (ACN Newswire) - RetailEX ASEAN 2018 ("RetailEX"), the largest annual international trade exhibition and conference in Southeast Asia, catering to retailers and brands focused on succeeding in ASEAN markets, is set to return better than ever before this September; with brand-new zones and content rich conferences over the three-day event.

RetailEX, under the theme "Transforming the ASEAN Retail Landscape" will be held on 19 to 21 September 2018, in Halls 3 and 4 at IMPACT Exhibition and Convention Center in Bangkok, Thailand. Over 4,000 attendees from diverse industries such as e-commerce and entertainment, healthcare, design and hospitality are expected to attend.

The three-day event is co-organised by the Thai Retailers Association ("TRA"), together with Clarion Events and IMPACT Exhibition Management Co., Ltd. ("IMPACT"), and is supported by the Thailand Convention and Exhibition Bureau ("TCEB"). Dr Chartchai Tuongratanaphan, Executive Director, TRA, emphasised at the press conference, how RetailEX ASEAN 2018 is defining retail within ASEAN. "Retail possibilities, expectations, behaviour and opportunities in the ASEAN community are evolving fast. Sharing our insights, knowledge and experience is absolutely essential; as is making those valuable connections and sourcing new products, services and even ideas. Retail beyond 2018 is unchartered territory and retailers and brands need to know how to navigate these newly emerging landscapes."

"RetailEX showcases the very best in cutting-edge retail technology innovation and solutions; acting as a must-visit, go-to marketplace as well as an insightful, industry knowledge-sharing platform with keynote speakers, workshops and invaluable networking opportunities," shared Mr. Loy Joon How, General Manager, IMPACT.

Mr. Charkrit Direkwattanachai, Vice President, Marketing Activation & Public Relations, Marketing Association of Thailand, adds "This is the first time that the Marketing Association of Thailand has partnered RetailEX to organise the 'Marketing in Retail' seminar. The objective of this seminar is to provide latest marketing trends and updates to retail brands. The seminar will feature many topics from various perspectives. This include consumer insights; how brands can differentiate themselves at point of sales; utilising big data for marketing strategy; case studies on omni channel; and how to integrate offline to online to revolutionise the retail industry."

Ms. Kanokporn Dumrongkul, Director of Exhibitions Department, TCEB, states "TCEB has been supporting RetailEX for four consecutive years. This year the bureau supported overseas marketing of the event and attracted trade buyers from ASEAN+6 countries through the Connect Businesses Campaign. The campaign aims to boost business matching between ASEAN+6 countries with the exhibitors, which will expand business opportunities in the event. TCEB expects that this support will generate more than 70 million baht revenue to the country. RetailEX will have a role in making Thailand an exhibition platform of ASEAN, in line with TCEB's policy. In 2017, TCEB-supported exhibitions experienced 126% growth in ASEAN trade visitors and 42.8% increase in ASEAN exhibitors."

New features at RetailEX

RetailEX is introducing several new features this year, to cover every aspect of retail from start-up to creating an outlet and succeeding online. These new highlights include:

-- Design Pavilion - showcasing the latest concept store designs to create greater customer engagement and experience;

-- Vending Machine & Self-Service Facilities Expo - primarily targeting the F&B industry, as well as offering payment and remote monitoring systems; photo booths; phone charge boxes; laundry room self-service equipment and more;

-- Inaugural launch of the ASEAN Retail Excellence Award - acknowledges the very best retailers and retail initiatives in ASEAN;

-- Dedicated Concierge Business Matching Programme - connecting regional and local buyers with exhibitors and sponsors; and

-- Launch of the Start-up Zone with the RetailEX Elevator Pitch - 10 shortlisted start-ups are given two minutes to pitch their ideas to 10 seasoned investors.

More varied content at RetailEX Conference

The RetailEX Conference promises more varied content, featuring a distinguished speaker panel of local and international industry who's who, including the CEO of 11Street; CTO of Central Group; COO of City Mart Holdings; Chief Strategy Officer of The Mall Group; Head of eCommerce from Unilever and many more, to share the latest retail trends and insights in Thailand and beyond. There will also be free on-floor seminars over the 3 days such as the Retail Training Program, organised by TRA, which explores industry trends, business models, branding and design development. The inaugural Marketing in Retail Seminar, held in conjunction with RetailEX, covers topics of interest for brands and marketers to build stronger brand identity and better scaling for their businesses.

RetailEX features more than 80 exhibitors and sponsors including Zendesk, Workplace by Facebook, AsiaPay, Insider, SpotOn Interactive, System Form, Thai Foretaste, SELF Electronics, Turbon (Thailand), AJIS (Thailand), Moderate, Quikframe, Secure Solution Asia, Smart ICT, Shenzhen COSUN Sign Engineering, Canon Ball Manufacturing, Changshu Hongda Business Equipment, and many more.

Registration is open to business visitors. For more show information and details, please visit the official website: www.retailexasean.com.

About RetailEX ASEAN

RetailEX ASEAN is an annual international trade exhibition and conference that caters to retailers and brands focusing on the ASEAN market, one of the fastest growing regions of the world. The exhibition serves as a marketplace for buyers to source for the latest retail related technology and solutions whilst the conference is an educational and knowledge-sharing platform for industry players to learn about the latest retail trends, helping companies to scale their businesses through practical case studies and insights from movers and shakers of the industry.

The 3-day event, happening in Bangkok, will attract 4,000+ key retail stakeholders and is designed to help brands and retailers transform their operations with various solutions and innovative technologies.

The event will take place from 19-21 September 2018 at Hall 3-4, IMPACT Exhibition and Convention Center. For more show information and details, please visit the official website: www.retailexasean.com.

Meet the Organizers

Thai Retailers Association has been established more than 30 years. At first the group was called the "Department Store Retailers Club", it was gathered by a group of department store entrepreneurs who realized that they must be corporate other stand individual in order to exchange ideas and share their visions as to developing an industry strategies as a whole. www.thairetailer.com

Clarion Events is one of the world's leading event organisers, producing and delivering innovative and market-leading events. Founded in 1947, its 760 employees based in 13 offices worldwide specialise in delivering first class marketing, networking, and information solutions in high value sectors, both in mature and emerging geographies. Clarion's customers use our range of exhibitions, conferences, tradeshows, and websites to target new business, demonstrate their products, build deeper relationships with their clients and identify new opportunities for performance improvement. Some of our most important core markets include Energy, Defence and Security, Telecoms, Payments, Retail, Infrastructure, and Resources. www.clarionevents.com

IMPACT Exhibition Management Co., Ltd. is the leading exhibition organizer in Thailand. IMPACT organizes and manages professional trade and public exhibitions, conferences, meetings and training, working in hand with international trade associations, organizers and corporations across a board spectrum of industries. We create effective market platforms and offer a comprehensive range of turn-key event management solutions ranging from market research, exhibition and visitor promotion and sales, advertising and promotion, public relations, operation to on-site logistic management for exhibitions and conferences of all sizes and industries. www.impact.co.th.

For more information, please contact:

Monyaphat Klinmontha (Fern), +66 90 8978167, pr@brandnow.asia

Kittima Kaur (Tinny), +66 81 8262399, kittima@brandnow.asia

Pattaraporn (Pond), +66 94 4930069, event@brandnow.asia

Brand Now Asia, +66 2 105 4217, www.brandnow.asia

About RetailEX ASEAN 2018

Copyright 2018 ACN Newswire. All rights reserved. www.acnnewswire.com