SINGAPORE, Aug 27, 2018 - (ACN Newswire) - CWX Global Limited ("CWX Global", SGX: 594), announced higher 4Q FY18 gross profit of US$0.9 million, an increase of 204% from US$0.3 million in 4Q FY17. This was mainly due to a 16% growth in revenue coupled with a 49% decrease in depletion cost of the Group's oil and gas properties in 4Q FY18 as compared to 4Q FY17.

- Higher average oil price of US$67 per barrel albeit lower oil production for the quarter

- Lower depletion cost of oil & gas properties reduced cost of sales by 30%

Group narrowed net loss from US$9.0M in 4Q FY17 to US$1.8M in 4Q FY18

- Excluding a gain on derecognition of deferred consideration of US$22.0M in 4Q FY17

- Active cost management while building its investment business

Going forward, Group expects growth from its Thailand oil concessions and investment business

- Encouraging results from drilling campaign in 2018 and targeting to explore more wells in the first half of 2019

- Group's associate company, FIT Global, commenced bilateral trading business in the second half of 2018

Stringent cost measures were carried out Group-wide, while the Group builds its investment business to balance the reliance on its 20% stake in the Thailand oil concessions. Operating expenses including administrative, other expenses and other charges, decreased by 76.0%, from US$8.8 million in 4Q FY17 to US$2.1 million in 4Q FY18.

Net profit after tax reversed from US$13.0 million in 4Q FY17 to a net loss after tax of US$1.8 million in 4Q FY18, mainly due to the absence of a one-off gain on derecognition of deferred consideration of US$22.0 in 4Q FY17. Excluding this gain, the Group would have narrowed its net loss after tax from US$9.0 million in 4Q FY17 to US$1.8 million in 4Q FY18.

Commenting on the performance, Mr. Jeffrey Pang, CEO and Executive Director of CWX Global said, "We continued to strengthen the Group through bolstering our balance sheet and building sustainable, profit-generating businesses for the long-term over the last financial year. These efforts will take time to bear fruit.

The Group's diversification into investment-related business is progressing well, albeit at a more modest pace amidst the geopolitical uncertainties, particularly the trade war between the United States and China. The oil and gas business segment continues to contribute positively with the higher oil prices, and we will continue our work on the Thailand concessions to realize more value over time.

Overall, the Group will continue to actively seek investment opportunities in a prudent manner to generate value for all shareholders."

While it is comforting that the oil prices have recovered from its lows, production from the older wells is seeing natural decline. The Joint Venture of the Thailand oil concessions is stepping up on its drilling efforts with the aim to reverse the decline in production and to take advantage of the current oil prices. At US$67, the post-tax cash flow is approximately US$30 per barrel.

The 2018 drilling campaign has successfully completed recently, with three out of three wells encountering hydrocarbons. The first two wells are in-fill/appraisal wells and have added more than 400 barrels of oil production a day to the existing production volume. Currently, flow testing on the third well, which is an exploration well, is underway. The initial flow results have been encouraging but further test is required to confirm its commercial viability. If it is successful, the new found reserves will be booked upon certification by an Independent Qualified Person.

The Joint Venture is also looking to build on the success of this drilling campaign with a new drilling campaign for follow-up wells in the first half of 2019. Currently, the profits and cash generated from the oil sales are sufficient to fund the drilling campaign.

For its investment business, the Group's associate, FIT Global, has just set up a bilateral trading business, providing access and quotes for exchange-traded and over-the-counter markets to its counterparties. The unit has been generating revenue since the commencement of operations in the second half of 2018. The Group expects its investment business to contribute as the business

grows.

As at 30 June 2018, the Group's balance sheet remains strong with net asset value at US$51.8 million. The net asset value per share was 1.60 US cents.

This press release is to be read in conjunction with the Company's results announcement posted on the SGX website on 24 August 2018.

About CWX Global Limited (Stock Codes - SGX: 594 | Bloomberg: CWX SP| Reuters: 594.SI)

CWX Global Limited ("CWX Global", SGX: 594), through the reorganisation of its business activities will be focusing on fund management, investment and trading. The Group, with its own team of professionals as well as through FIT Global Pte. Ltd., a strategic joint venture, will seek to offer a holistic suite of fund management and trading services for managed funds which are accessible to corporate and institutional investors.

The Group will be primarily involved in: (i) investments, including private equity deals, pre-initial public offerings (mature stage), initial public offerings, fixed income and hybrid instruments; (ii) trading, including the trading of equities, commodities and other financial instruments, including cryptocurrencies; (iii) fund management; and (iv) market making for commodities.

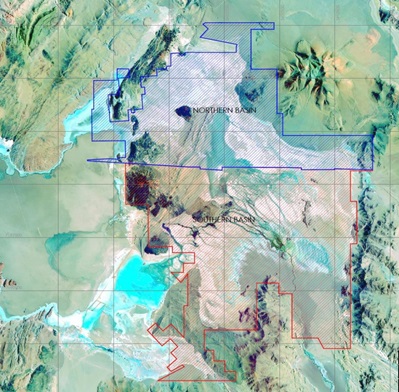

The Group's 20% stake in the Thailand onshore oil concessions located at Phetchabun Basin is presently its key investment. These concessions currently generate a steady income stream from its existing oil producing wells which, together with substantial proven reserves for development as well as significant potential exploration upside, holds the promise of value enhancement and sustainable long-term growth.

The Group believes diversifying into the investment and trading platforms will benefit both investors and shareholders alike, enhancing risk management and creating values for all.

For more information, please visit the company's website at www.cwxglobal.com

This press release has been prepared by the Company and its contents have been reviewed by the Company's sponsor, ZICO Capital Pte. Ltd. (the "Sponsor"), for compliance with the Singapore Exchange Securities Trading Limited (the "SGX-ST") Listing Manual Section B: Rules of Catalist. The Sponsor has not independently verified the contents of this press release.

This press release has not been examined or approved by the SGX-ST and the SGX-ST assumes no responsibility for the contents of this press release, including the correctness of any of the statements or opinions made or reports contained in this press release.

The contact person for the Sponsor is Ms. Alice Ng, Director of Continuing Sponsorship, ZICO Capital Pte. Ltd. at 8 Robinson Road, #09-00 ASO Building, Singapore 048544, telephone +65 6636 4201.

Copyright 2018 ACN Newswire. All rights reserved. www.acnnewswire.com