|

|

|

|

|

|

|

Source: iResearch |

|

|

|

|

|

Source: iResearch |

|

|

|

|

|

|

|

|

|

|

HONG KONG, Aug 31, 2018 - (ACN Newswire) - Investment highlights:

- Tubatu is the first company that has realized profit in the industry, with the adjusted net profit of RMB63.50 million in 2017

- In terms of MUV, GMV, transaction value and platform revenue, Tubatu ranks No. 1 in the industry and is far ahead of its peers

- While favored repeatedly by top VC/PE firms such as Matrix Partners China and Sequoia Capital in the pre-IPO rounds of investment, Tubatu also received the strategic investment from WUBA (58.com), which is win-win cooperation

As one of the top 3 financial centers in the world, Hong Kong's capital market becomes increasingly important to mainland China. According to the statistics, there were nearly 1,000 mainland enterprises listed in Hong Kong at the end of December 2017, with a total market capitalization of approximately US$3 trillion, accounting for approximately 66% of the total market capitalization.

IPO surge in Hong Kong's capital market sets China's third Internet listing boom off

Hong Kong's capital market sees IPO surge this year. According to the information disclosed by Hong Kong Exchanges and Clearing Limited ("HKEX"), Hong Kong saw 135 IPOs completed from January to July 2018, hitting a new record high in the Hong Kong market with year-on-year growth of 40 or 42% from 95 in the same period last year. There were 75 new listings on the Main Board and 60 on GEM, as compared with 44 and 51 in the same period last year respectively.

Total Number of IPOs in Hong Kong's Capital Market

From January to July 2018 From January to July 2017 From January to December 2017

Hong Kong Main Board 75 44 81

- IPO 72 44 80

- Listing by Introduction 3 0 1

GEM 60 51 80

Total 135 95 161

Source: HKEX

The most iconic issuer in the IPO boom is Xiaomi Group (01810.HK), the first company listed in Hong Kong with "weighted voting rights" (WVR) structures on July 9 and total proceeds of HK$42,611 million. It is the world's fourth largest tech IPO after Alibaba, Facebook and Infineon.

After Alibaba decided to list its shares on the U.S. stock market in 2014, Charles Li Xiaojia, Chief Executive of HKEX, responded that, "We feel proud of Hong Kong as we ensure that our rule of law remain intact.". What Li Xiaojia had said then was the fact that the bourse rejected Alibaba's listing application due to its adherence to the "one share, one vote" principle. Unexpectedly, the development has turned a 180-degree reversal out this year. HKEX issued new rules on IPOs on April 24, 2018 to permit listings of biotech companies without profit and new-economy companies with dual share class (weighted voting rights) structures in Hong Kong, which formally came into effect on April 30. Since then, Hong Kong's capital market has set the "third Internet listing boom" off in China. In particular, July 12 marked the most spectacular day when five of the eight companies going public on HKEX had new-economy business models.

The listing boom of Chinese Internet Companies

Time Representative Companies Listing place

The first listing boom of Chinese Internet Companies 2000 NetEase, Sohu, Shanda and Baidu US

The second listing boom of Chinese Internet Companies 2014 Alibaba and JD US

The third listing boom of Chinese Internet Companies 2018 Xiaomi, Liepin, Ping An Good Doctor and E-house Hong Kong

HKEX launches listing regime for companies from emerging and innovative industries

After recognizing the reality of missing opportunities of having new-economy companies such as Alibaba listed in Hong Kong, HKEX has made the most significant reform in its listing rules. After the release of its conclusions on the New Board Concept Paper on December 15, 2017, HKEX published the Consultation Paper on a Listing Regime for Companies from Emerging and Innovative Sectors on 23 February 2018, and issued new rules on IPOs on April 24, 2018, to permit biotech companies without profit and new-economy companies with dual share class (weighted voting rights) structures in Hong Kong.

Listing Regime for Companies from Emerging and Innovative Industries

Formulation Formulation Optimization

New listing rules New chapter on Biotech companies New chapter on different vote rights Related to the secondary listing rules

Applicable companies Companies without revenue Companies with unconventional governance structure Mainland and international companies

Thus, Xiaomi managed to be the first company listed in Hong Kong with weighted voting rights(WVR) structures on July 9. 8 biotech companies without profit or even revenue, had officially submitted their IPO application in Hong Kong as of July 20. On 1 August, Ascletis Pharma Inc., the first biotechnology company without profit listed in Hong Kong, officially had its trading debut on HKEX with a market capitalization of approximately HK$16 billion.

The reason why the "one share, one vote" system becomes the biggest obstacle for mainland emerging Internet tech companies to go public in Hong Kong is that they had relied on continuous venture capital financing to grow rapidly and the founder's percentage of equity interest will inevitably suffer a significant dilution. Taking Xiaomi as an example. Before its listing in Hong Kong, Xiaomi Group had experienced 9 rounds of financing and Lei Jun, the founder, chairman and CEO of Xiaomi, only held 31.41% equity interest. After the AB dual-class share structure, each A share can have 10 votes, while each B share can have 1 vote. Hence, Lei Jun's voting rights ratio exceeds 50%, becoming the controlling shareholder of Xiaomi Group. The WVR system can guarantee the founder's control over the enterprise.

Tubatu: China's largest and best online home renovation platform files an A1 application; Expected to list in Hong Kong in the fourth quarter of this year

After a wave of listing of Chinese outstanding Internet companies in July, Tubatu, China's largest and most active online home renovation platform and ecosystem, has recently submitted its A1 application to HKEX under the sole sponsorship of Citibank, a world-renowned investment bank.

Established in 2008, Tubatu's mission is "to leverage technologies to improve home living". Tubatu has been the largest online home renovation platform in China by gross merchandise value or GMV, transaction value and platform revenue in each of 2015, 2016 and 2017 and the six months ended June 30, 2018, according to iResearch. Tubatu is also the most active and dynamic online home renovation ecosystem in China by the number of service providers and content richness as of June 30, 2018, and average monthly unique visitors or average MUV in the six months ended June 30, 2018, according to iResearch.

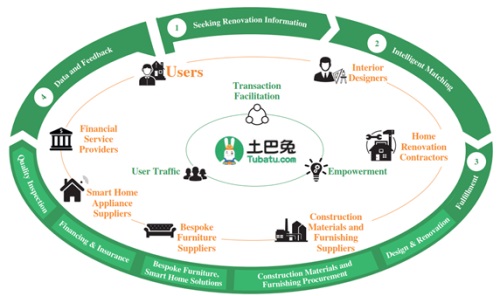

An energetic and dynamic ecosystem has evolved around Tubatu's platform as illustrated in the diagram below:

For the home renovation industry in China, Tubatu's innovative platform has significantly improved the business efficiency and transparency of the home renovation market and helped restore the trust between homeowners and home renovation contractors in China. Meanwhile, Tubatu's ecosystem has unique value propositions for each of its participants.

- Value to users: Tubatu is committed to becoming the trusted internet home renovation platform for every family in China. The one-stop home renovation solution provides convenience, cost-saving, transparency and security to homeowners. By utilizing the platform, users of the Company are able to initiate home renovation or interior design requests and obtain fee quotes with ease and fewer costs via the internet. Users have access to updated and rich contents relating to home renovation and interior design provided through our online platform. Tubatu's industry leading user review and rating system gives users transparency and comfort they need in choosing service providers to perform their orders. Additionally, users can benefit from the mandatory escrow services and utilize the inspection managers for quality inspection to ensure quality of the home renovation work despite any lack of relevant knowledge or experience.

- Value to service providers: Tubatu aims to build an enabling platform that encourages service providers' entrepreneurship and innovations around home living with aesthetics, well-being, technology and happiness. Tubatu's SaaS-based information infrastructure assists service providers to digitize their operations, improve their customer acquisition and operational efficiency, reduce operating costs and find stable financing. Taking advantage of the database and intelligent matching system, Tubatu matches service providers with users at a high success rate, therefore enabling them to acquire customers and build reputation more efficiently than before joining our ecosystem. Tubatu's escrow services give comfort to service providers with respect to the homeowners' ability to pay for their work. Service providers can also benefit from the supply chain financing services offered through the platform to meet their working capital needs. They can also take advantage of the SaaS-based solutions, such as CRM, project management and supply chain management systems, to better understand and serve the needs of users.

Due to its unique commercial value, Tubatu has been highly recognized by venture capital firms since its establishment, and has continuously obtained investments from well-known investment institutions, such as Matrix Partners and Sequoia Capital China, as well as 58.com, China's leading housing information platform. It is worth noting that the top venture capital, Matrix Partners, participated in all series A, B and C pre-IPO investment since 2011. As the company's earliest investor, it is also the institutional investor that knew the Company best, whose confidence is really rare. Sequoia Capital, a well-known PE institution, that is always selective in investment, has continued to raise its investment in the follow-up series C financing after the first participation in series B, and has once again cast a trust poll in the company's business development. 58.com, whose major shareholder is Tencent, has taken a strategic stake in the series C investment, and its win-win cooperation with Tubatu will bring promising prospects for resource sharing and coordinated development.

Until December 2017, Tubatu had been the leading platform in the industry in terms of users by statistics provided by third-party statistic institutions such as iResearch and Analysys. As of June 30, 2018, Tubatu's online platform had coverage across 307 cities in China, and had approximately 84,500 contractors, 1.1 million designers, and 1,290 suppliers, and cumulatively served 26.30 million users, which had become the NO. 1 choice for Chinese people in home renovation.

China's flourishing online home renovation market and its pain points and solutions

According to iResearch, from 2012 to 2017, the market size of China's interior design and construction services industry by revenue increased from RMB1.34 trillion to RMB2.1 trillion, representing a CAGR of 9.4%. Due to the growth in urbanization rate, population migration, and the promising prospects of the housing leasing market, the market size by revenue is expected to reach RMB2.62 trillion in 2020, with a CAGR of 7.7% from 2017 to 2022.

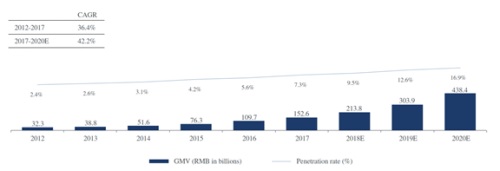

According to iResearch, China's online penetration of home renovation services by GMV has grown from 2.4% in 2012 to 7.3% in 2017, which is expected to increase to 16.9% in 2020.

The market size of China's online home renovation by transaction value increased from RMB2.70 billion in 2012 to RMB16.63 billion in 2017, representing a CAGR of approximately 44%. In view of the low penetration rate in 2017, the market obviously showed high growth potential. It is expected the market will grows rapidly to RMB54.21 billion by 2020, representing a CAGR of 48.3%.

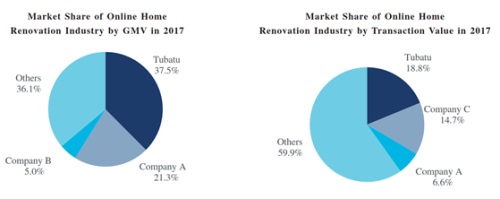

In 2017, Tubatu was the largest player by GMV in the PRC online home renovation market, with a market share of 37.5%, according to iResearch. During the same year, Tubatu was the largest player by transaction value in the online home renovation industry, with a market share of 18.8%. The following graphs illustrate the competitive landscape of the online home renovation market in China in 2017:

As the graphs shown, in 2017, Tubatu had the largest online platform revenue of approximately RMB410 million, followed by its closest competitor with a platform revenue of approximately RMB190 million.

Backed by a huge home renovation market of RMB2.1 trillion, the online home renovation market is growing at a CAGR of 44%-48%. At present, the first pain point for home owners is asymmetrical information. The cost of communication and decision-making between homeowners and contractors is quite high. Users worry about choosing the wrong contractor, being cheated or malicious additions, which showed serious trust problems. Secondly, users' funds are not safe because their contractors may run away. The third pain point is quality control. It is difficult to control the workers at the user end, which will cause many problems, such as project delays.

Can Tubatu's online home renovation platform model solve the pain points of home renovation above? Let's have a look at the solutions provided by China's largest and most active online home renovation platform and ecosystem.

1. First of all, Tubatu solves the pain point of asymmetrical information by changing the connection mode between various roles of the home renovation industry. Tubatu solves the problem through matching transaction system provided by the platform and the "cloud word-of-mouth system" similar to Ali Taobao, which has created trust space for contractors and users and reduced users' decision-making cost of choosing home renovation. It is also unnecessary for contractors to acquire customers through telephone marketing or community visits. Thus, it changes the original connection mode of the industry.

2. Tubatu changes the transaction mode. Based on its online home renovation platform, Tubatu has launched the Zhuangxiubao escrow services, known as "Alipay in Home Renovation Industry", and quality inspection manager services. In order to help solve the capital chain difficulties of the industry, Tubatu has initiated supply chain financial services with third-party financial institutions, which solves the problem of capital security during the transaction process of the contractors and the cash flow issue in the construction management and operation process of contactors, thus changing the original transaction mode of the industry.

3. Tubatu also changes the production mode, in the respect of supply chain empowerment, big data, SaaS and education and training.

Tubatu is the largest and true online home renovation platform in the industry

The solutions above provided by Tubatu to solve pain points of the industry have enhanced the efficiency of the industry and reduced the cost. We can see that these changes can only be made by enterprises with platform model because only the platform model will promote the development of the industry from the perspective of the whole industry chain.

As the largest online home renovation platform in the industry, Tubatu derives most of its revenue from the platform business, which is truly developed around the platform model. Tubatu's platform can provide infrastructures, enable transactions, and reduce intermediate links, which help improve the efficiency of the industry. At present, only Tubatu has met these three points at the same time in the industry.

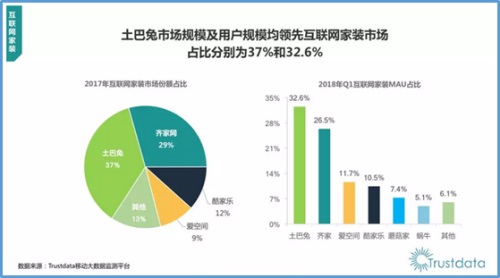

Trustdata has released the "2018 Q1 China Mobile Internet Industry Development Report". As shown in the figure above, the market share of Tubatu was 37%, and its monthly active users (MAU) accounted for 32.6%, ranking No. 1 in the industry.

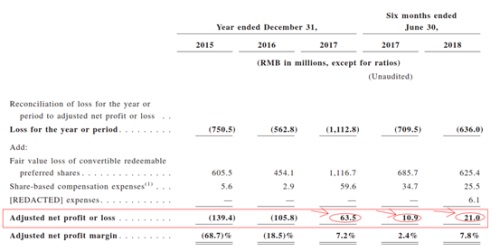

Even more remarkably, Tubatu realized meaningful profit As shown in the table below, Tubatu's adjusted net profit was RMB63.50million in 2017, and it realized c.100% growth for the first half of 2018, from RMB10.9 million in the same period in 2017 to RMB21 million.

While many other online home renovation enterprises are still loss making, we have confidence that Tubatu, which is the first to realize profit, is best positioned for the fierce competition in the industry with the strong support from its top pre-IPO investors. The market is looking forward to Tubatu's IPO in Hong Kong this year.

Copyright 2018 ACN Newswire. All rights reserved. www.acnnewswire.com